税理士の使命

税理士及び税理士法人(以下「税理士等」といいます。)は、税務に関する専門家として、独立した公正な立場において、申告納税制度の理念に沿って、納税者の信頼に応え、租税に関する法令に規定された 納税義務の適正な実現を図るという公共的な使命を負っています。

令和 4(2022)年 3 月末現在で、全国で 80,163 人の税理士が登録を受け、また、4,601社の税理士法人が設立されています。

Missions of Certified Public Tax Accountants (CPTAs)

Certified Public Tax Accountants (CPTAs) and CPTAs Corporations (hereinafter referred to as“CPTAs etc.”) are professional specialists on taxes. Their public mission is to respond to the trust of a taxpayer in line with the principles of the self-assessment system and to achieve proper tax compliance as provided for in the tax laws and regulations, based on their independent and fair standpoint.

As of the end of March 2022, 80,163 persons were registered as CPTAs, and there were 4,601 CPTAs Corporations.

税理士の業務と役割

納税者をサポートし申告納税制度を推進

税理士業務(①税務代理、②税務書類の作成、③税務相談)は、たとえ無償であっても税理士等でない者は行ってはならないこととされており、同時に、税理士等に対しては、脱税相談やその信用又は品位を害する行為の禁止などの義務と責任が課されています。

納税者は、税理士等のサポートを受け、適正に申告・納税することができ、また、帳簿の作成や決算などの会計業務についても依頼等するケースが多く、税理士等は税務申告や、その基礎となる正しい記帳の推進においても重要な役割を果たしています。

Services and roles of CPTAs

Support taxpayers and boost the self-assessment system

CPTA services are tax proxy, preparation of tax documents, and tax consultation service. These operations must not be performed by persons other than CPTAs, even at no charge. At the same time, CPTAs are required to fulfill various obligations and responsibilities. For example, they are prohibited from providing tax evasion consultation and engaging in conduct that harms the credibility or dignity of CPTAs.

If using the services of CPTAs, taxpayers can properly file returns and pay taxes. In addition, because corporations and sole proprietors often ask CPTAs to process accounting books or to compile financial statements, they also play important roles in promoting tax return filings and correct bookkeeping that constitutes the basis for the filing.

In compliance with Article 51 of the Certified Public Tax Accountant Act, CPTA services can also be performed by lawyers and legal professional corporations that have notified their practice of CPTA services to the Regional Commissioner with jurisdiction over the district where CPTA services are to be provided, as well as CPTAs and CPTAs Corporations.

税理士会と日本税理士会連合会

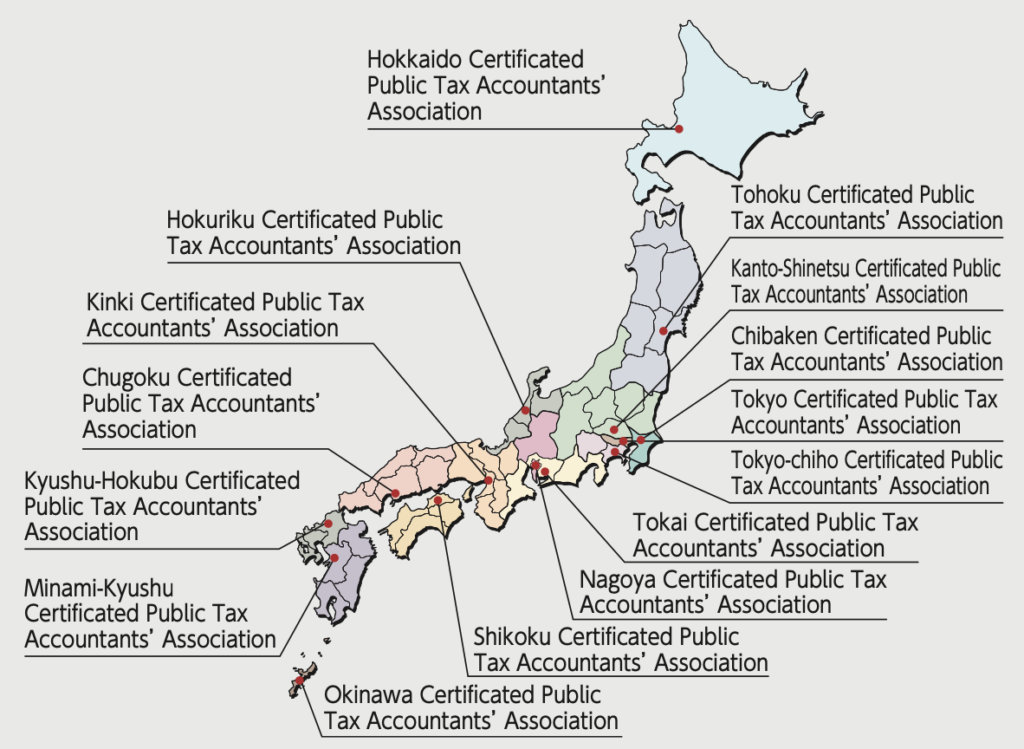

税理士会は、税理士業務の改善進歩等のために、税理士等 の指導、連絡や監督を行う、税理士法に定められた団体です。 現在、全国に15の税理士会があり、各税理士会では、①税理士の資質の向上のための研修、②租税教育の充実のため、小・ 中学校、高等学校及び大学等への講師派遣、③小規模納税者などに対する無料税務相談など、幅広い活動を行っています。

また、日本税理士会連合会は、税理士法に定められた全国で唯一の団体です。税理士会や税理士等に対する指導、連絡や監督に関する事務のほか、税理士の登録に関する事務、税理士等に関する制度についての調査研究などの活動を行っています。

CPTAs’Associations and Japan Federation of CPTAs’Associations

In order to improve the work of CPTAs, CPTAs’Associations are designated in the CPTA Act as organizations that provide guidance, liaison, and supervision to CPTAs. There are now 15 CPTAs’Associations throughout Japan. CPTAs’Associations engage in a wide range of activities, including ① training to enhance the qualities of CPTAs, ② dispatch of lecturers for tax workshops in elementary, junior, and senior high schools, universities, etc. to fulfill the tax education, and ③ free tax consultation for small taxpayers.

The Japan Federation of Certified Public Tax Accountants’ Associations (https://www.nichizeiren.or.jp/eng/) is the only organization in Japan certified by the CPTA Act. The Federation provides guidance for, communicates with, and supervises CPTAs’Associations and CPTAs. It also handles the operation to register members and conducts institutional surveys on CPTAs.