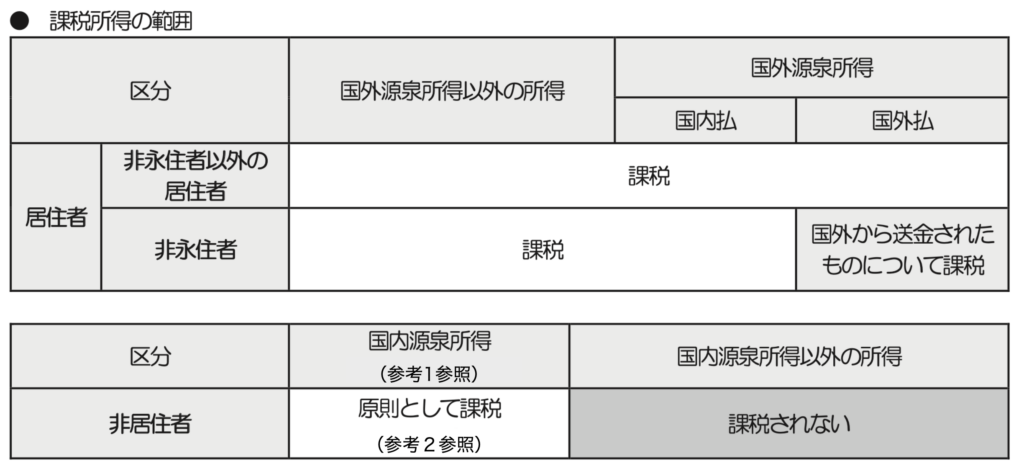

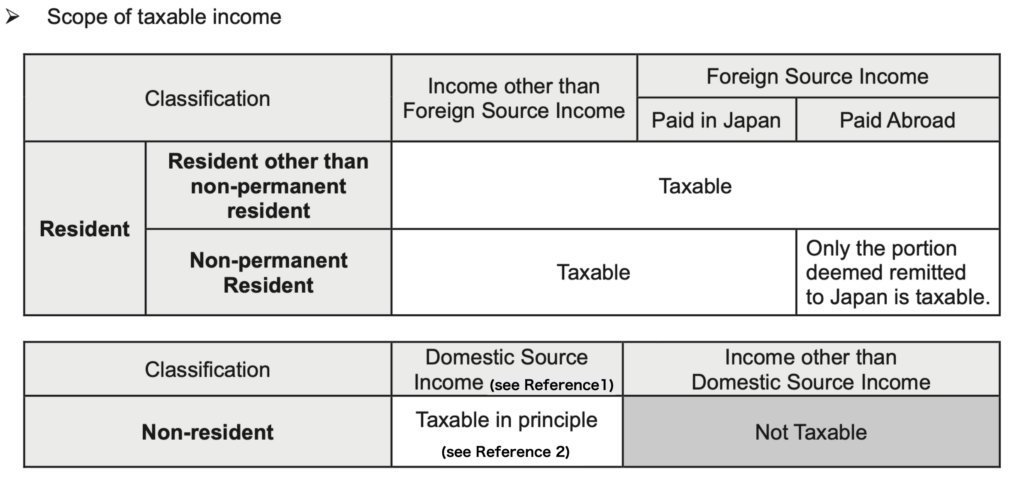

Taxpayers and the scope of taxable income(Scope of taxable income)

1 非永住者以外の居住者

全ての所得について所得税等を納める義務があります。

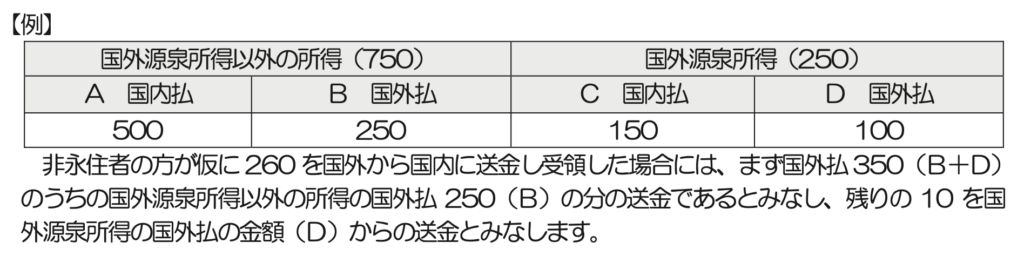

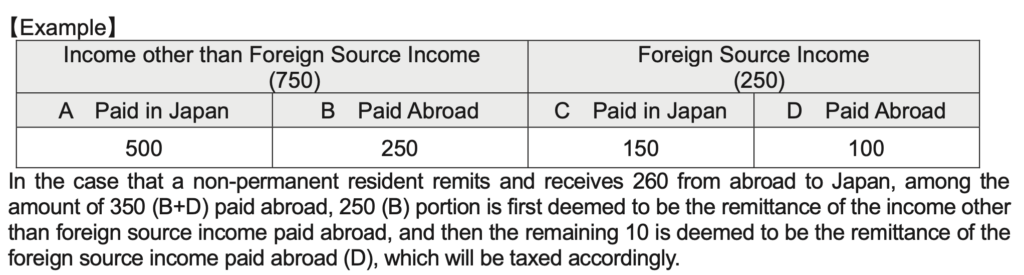

2 非永住者

国外源泉所得以外の所得及び国外源泉所得で国内において支払われたもの又は国外から送金されたものについて所得税等を納める義務があります。

※ 「国外から送金されたもの」とは、非永住者が各年において国外から国内に送金し受領した金額のう

ち、その年における「国外源泉所得以外の所得の国外払の金額を超えたもの」をいいます。

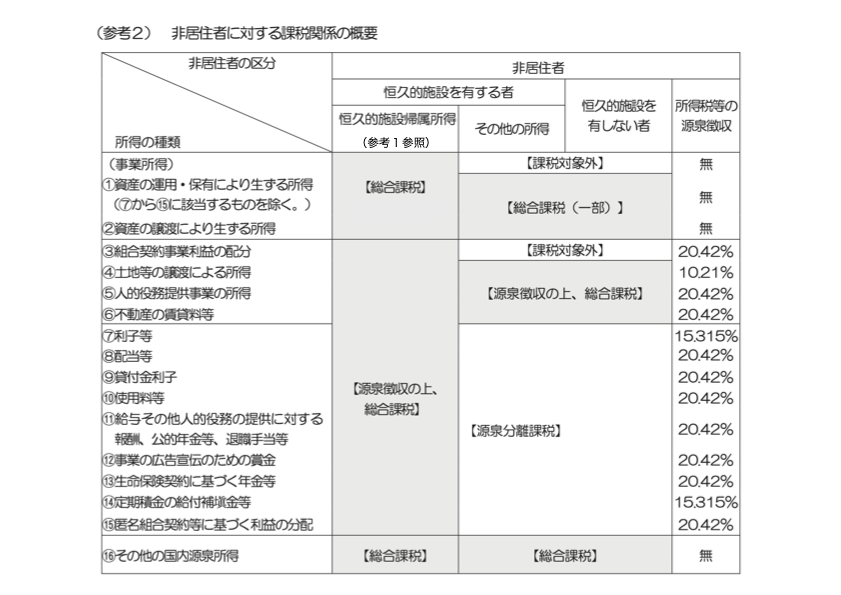

3 非居住者

国内源泉所得について所得税等を納める義務があります。

(参考1) 国内源泉所得 下記のものは国内源泉所得として取り扱われます。

1 恒久的施設帰属所得(※1)

2 国内にある資産の運用又は所有により生ずる所得

3 国内にある資産の譲渡により生ずる所得

4 組合契約(※2)等に基づいて恒久的施設を通じて行う事業から生ずる利益で、その組合契約に基づいて配分を受けるもののうち一定のもの

5 国内にある土地、土地の上に存する権利、建物及び建物の附属設備又は構築物の譲渡による対価

6 国内において人的役務の提供事業を行う者が受ける、その人的役務の提供に係る対価

7 国内にある不動産や不動産の上に存する権利等の貸付けにより受け取る対価

8 日本の国債、地方債、内国法人の発行した社債の利子、外国法人が発行する債券の利子のうち恒久的施設を通じて行う事業に係るもの、国内の営業所に預けられた預貯金の利子等

9 内国法人から受ける剰余金の配当、利益の配当、剰余金の分配等

10 国内で業務を行う者に貸し付けた貸付金の利子で当該業務に係るもの

11 国内で業務を行う者から受ける工業所有権等の使用料、又はその譲渡の対価、著作権の使用料又はその譲渡の対価、機械装置等の使用料で国内業務に係るもの

12 給与、賞与、人的役務の提供に対する報酬のうち国内において行う勤務、人的役務の提供に基因するもの、公的年金、退職手当等のうち居住者期間に行った勤務等に基因するもの 13 国内で行う事業の広告宣伝のための賞金のうち一定のもの

14 国内にある営業所等を通じて締結した保険契約等に基づく年金等

15 国内にある営業所等が受け入れた定期積金の給付補てん金等

16 国内において事業を行う者に対する出資につき、匿名組合契約等に基づく利益の分配

17 その他の国内源泉所得

例えば、国内において行う業務又は国内にある資産に関し受ける保険金、補償金又は損害賠償金に係る所得がこれに当たります。

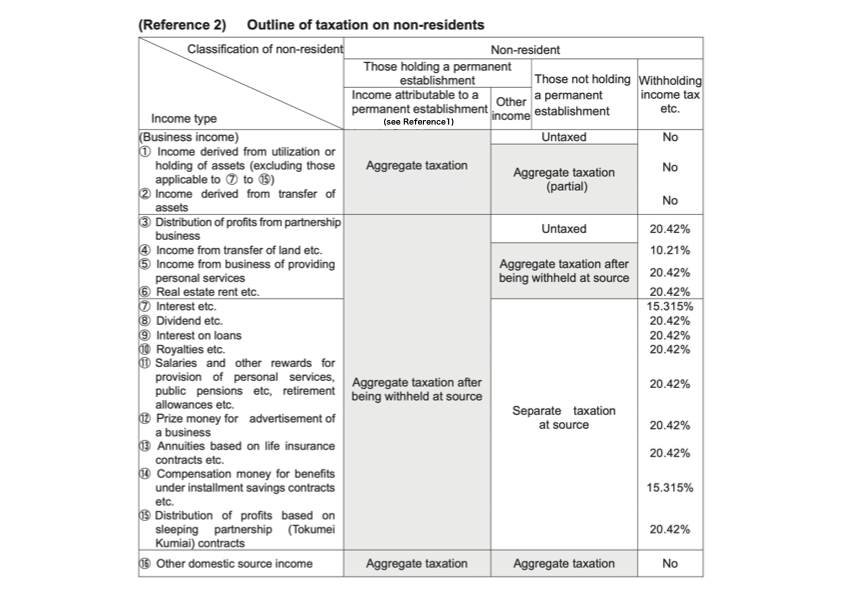

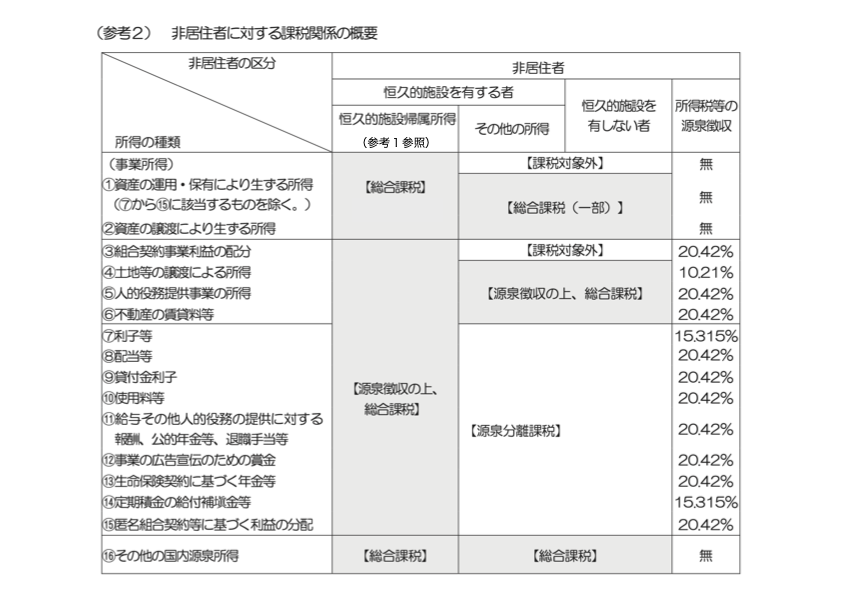

これらについての課税方法は、国内源泉所得の種類、恒久的施設の有無、国内源泉所得が恒久的施設に帰せられる 所得か否かによって異なります。なお、租税条約によって国内源泉所得について異なる定めがある場合は、租税条約 に従うことになります。

※1 恒久的施設が非居住者から独立して事業を行う事業者であるとしたならば、当該恒久的施設が果たす機能、当 該恒久的施設と当該非居住者の事業場等との間の内部取引その他の状況を勘案して、当該恒久的施設に帰せられ るべき所得をいいます。

※2 この場合の組合契約とは、次に掲げる契約をいいます。

(1) 民法第 667 条第1項に規定する組合契約

(2) 投資事業有限責任組合契約に関する法律第3条第1項に規定する投資事業有限責任組合契約

(3) 有限責任事業組合契約に関する法律第3条第1項に規定する有限責任事業組合契約

(4) 外国における契約で、(1)から(3)の契約に類する契約

※3 当該土地等を自己又はその親族の居住の用に供するために譲り受けた個人から支払われる対価で譲渡対価が1億円以下のものは5から除かれ3に該当することとなります。

※4 シッパーズ・ユーザンス手形及び輸入ユーザンス手形で履行までの期間が6か月を超えないものの利子は、10 に含まれません。

※5 内国法人の役員としての勤務及び居住者又は内国法人が運航する船舶又は航空機で行われる役務の提供は、現実における提供の場所のいかんを問わず国内で行われたものとみなされます。

※6 国内で行う人的役務の提供に基因して受ける給料、賃金その他の報酬は、たとえ日本国内で支払われない場合においても国内源泉所得とされます。

(注)

1 恒久的施設帰属所得(参考1)が、上記の表1から16までに掲げる国内源泉所得に重複して該当する場 合があることに留意してください。

2 上記の表2(資産の譲渡により生ずる所得)のうち恒久的施設帰属所得に該当する所得以外のものについては、所得税法施行令第281条第1項第1号から第8号までに掲げるもののみ課税されます。

3 租税特別措置法の規定により、上記の表において総合課税の対象とされる所得のうち一定のものについては、 申告分離課税又は源泉分離課税の対象とされる場合があることに留意してください。

4 租税特別措置法の規定により、上記の表における源泉徴収税率のうち一定の所得に係るものについては、軽 減又は免除される場合があることに留意してください。

5 非居住者の居住地国と日本の間で租税条約が締結されている場合には、その租税条約の定めるところにより 課税が軽減又は免除される場合などがあります。

1) Residents other than non-permanent residents

Residents other than non-permanent residents are obligated to pay the income tax etc. for their whole income.

2) Non-permanent residents

Non-permanent residents are obliged to pay income tax etc. with respect to their (a) income other than foreign source income, (b) foreign source income paid in Japan and (c) foreign source income paid abroad and remitted to Japan from abroad.

The amount “remitted to Japan from abroad” means, among the amount remitted and received by non- permanent residents from abroad to Japan in each year, “the amount exceeding the amount of the income other than foreign source income paid abroad” in that year.

3) Non-residents

Non-residents are obligated to pay the income tax etc. for their domestic source income.

(Reference 1) DOMESTIC SOURCE INCOME

The following income is treated as domestic source income:

(1) Incomeattributabletoapermanentestablishment.

(2) Income from the utilization or possession assets located in Japan.

(3) Income from the transfer of assets located in Japan.

(4) Certain distributions derived from the profits of a business conducted through a permanent establishment based on a partnership contract and received in accordance with the provisions therein.

(5) Income from sale or disposal of land, rights established on land, buildings, and facilities attached to buildings, or structures in Japan.

(6) Income received as compensation by business operators providing personal services in Japan, including compensation for services provided by motion picture artistes, musicians and any other entertainers, professional athletes, lawyers, accountants, and other professionals, or persons possessing scientific, technical, or managerial expertise or skills.

(7) Rent or other compensation for the use or lease of real estate in Japan and rights therein or established thereon.

(8) Interest on national and local government bonds and debentures issued by domestic corporations; interest on debentures issued by foreign corporations that is attributable to business conducted through a permanent establishment; interest on savings deposited to entities located in Japan, etc.

(9) Dividends on surplus, dividends of profits, distribution of surpluses received, etc. from domestic corporations.

(10) Interest on loans that are provided for business operators for their business conducted in Japan.

(11) Royalties or proceeds from the sale of industrial property rights and copyrights, and rental charges on

equipment that are received from business operators for their business conducted in Japan.

(12) Salaries, bonuses, or compensation for the provision of personal services resulting from employment and other personal services provided in Japan; and public pensions and severance allowances derived from employment, etc. offered during the resident taxpayer period.

(13) Monetary awards for the advertisement of a business conducted in Japan.

(14) Pensions, etc. based on life insurance contracts concluded through entities located in Japan.

(15) Money for payment for installment savings accounts, etc. received by entities located in Japan.

(16) Distributions of profits based on silent partnership arrangements, etc. for contributing capital to a business operating in Japan.

(17) Other domestic source income including that concerning insurance benefits and compensations for damages received in conjunction with business conducted in Japan or assets located in Japan.

Taxation method for the above varies depending on the type of domestic source income, whether there is a permanent establishment, and whether the domestic source income is attributable to a permanent establishment. When domestic source income is provided differently in any tax treaty, the tax treaty prevails.

Note: 1. Attributable income to the permanent establishment means the income that is attributable to the permanent establishment, taking into account the functions the permanent establishment performed, the dealings between the permanent establishment and non-resident’s place of business, and the other condition, if the permanent establishment is the business operator independent from the non-resident.

Note: 2. The following are examples of contracts falling under the classification “contract of partnership.”

(1) Contract of partnership as provided for in Article 667(1) of the Civil Code.

(2) A venture capital investment limited partner-ship agreement as stipulated in Section 3, Article 1 of the Law Relating to Venture Capital Investment Limited Partnerships;

(3) A limited liability partnership agreement as stipulated in Section 3, Article 1 of the Law Relating to Limited Liability Partnerships;

(4) Contracts concluded in a foreign country and similar to those described in (1) through (3) above.

Note: 3. Income received from a person who uses a purchased property as a dwelling place for himself / herself or his / her relatives is not the income of (5) but the income of (3) when the income is not more than 100,000,000 yen.

Note: 4. Interest on shipper’s usance bills and bank import usance bills which is payable within six months of the date of issuance should not be included in the income of (10).

Note: 5. Services rendered as a director of a domestic corporation and services provided aboard a ship or aircraft operated by a resident or a domestic corporation are deemed to have been performed in Japan regardless of where such services are performed in reality.

Note: 6. Salaries, wages, and other remuneration for personal services performed in Japan are treated as domestic source income even if they are not paid in Japan.

Note:

- Please note that income attributable to a permanent establishment (see Reference1) may overlap with domestic source income stated in 1 to 16 in the table above.

- Of the “2 Income derived from transfer of assets” in the table above, income other than those falling under income attributable to a permanent establishment is taxed only if the income corresponds to those listed in Article 281, paragraph 1, item 1 to 8 of the Order for Enforcement of the Income Tax Act.

- Please note that certain ones of the income subject to aggregate taxation in the table above may be subject to separate self-assessment taxation or separate taxation at source pursuant to the provisions of the Act on Special Measures concerning Taxation.

- Please note that withholding tax rates in the table above relating to certain incomes may be reduced or exempted pursuant to the provisions of the Act on Special Measures concerning Taxation.

- In cases where a tax treaty is concluded between the country of residence of the non-resident and Japan, taxation may be reduced or exempted pursuant to the tax treaty.

コメント