What is the final return?

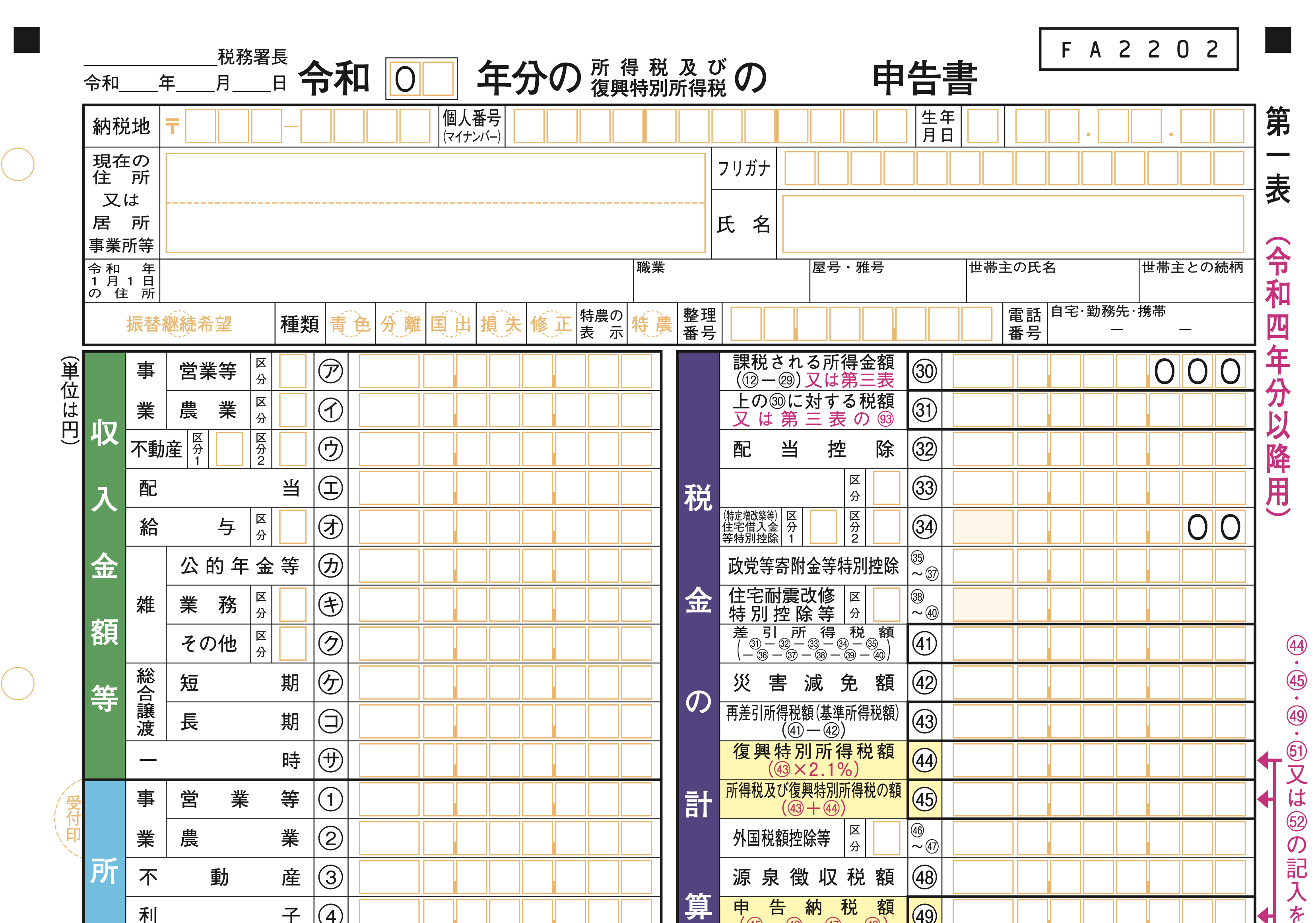

日本の所得税は、その年の1月1日から 12 月 31 日までの1年間に生じた所得について、居住形態の区分に 応じ(1-3 参照)、自ら所得の金額とそれに対する所得税等の額を計算して、翌年の申告期限までに確定申告書 を提出し、源泉徴収された税金や予定納税で納めた税金などとの過不足を精算する手続を採用しています。この 手続を確定申告といいます。

- 日本の所得税は、申告納税制度を採用しています。申告納税制度とは、納税者が行う申告により第一次的 に税額が確定する効果を認める制度です。この制度は、自分の所得の状況を最もよく知っている納税者自身 が、自分で所得金額とその所得金額に対する税額を計算し、自らの責任において適正な申告を行うものです。

- 日本の所得税は、特定の所得については、申告納税制度と併せて源泉徴収制度を採用しています。源泉徴 収制度とは、給与や退職手当、利子、配当、報酬などを支払う者が、その支払の際に一定の所得税等の額を 支払金額から差し引いて、所得税等を国に納付するというものです。

- 平成 25 年分から令和 19 年分まで、東日本大震災からの復興を図るための施策に必要な財源を確保する ため、復興特別所得税(原則として各年分の所得税額の 2.1%)を所得税と併せて申告・納付することとさ れています。この手引きでは、所得税及び復興特別所得税を「所得税等」といいます。

The income tax in Japan adopts procedures to calculate by the taxpayers themselves the amount of taxable income and income tax etc. on the income in accordance with their own type of residential status (see 1-3), file a final return by the due date of the following year, and settle the excess or deficiency with the amount of tax withheld or estimated tax prepayment, regarding the income earned during the year from January 1 to December 31 of that year. This procedure is called a final return.

- Income tax in Japan adopts the self-assessment system. The self-assessment system is a system under which the tax amount is primarily determined through the filing of a tax return by each taxpayer. Under this system, taxpayers, who best know the state of their own income, calculate the amount of taxable income and the tax on the income by themselves and file proper returns on their own responsibilities.

- Income tax in Japan adopts the withholding tax system for specific incomes along with the self-assessment system. Under the withholding tax system, the payers of salaries and wages, retirement allowance, interest, dividends, and fees etc. withhold the certain amounts of income tax etc. at the time of payment and pay them to the national treasury.

- You are advised that “Special Income Tax for Reconstruction” is added to the income tax for each year from 2013 through 2037. This tax is 2.1% tax on the amount of your income tax to help finance various measures of reconstructions from the aftermath of 2011 Tohoku earthquake and tsunami, which is also referred to as the Great East Japan Earthquake. In this guide, income tax and special income tax for reconstruction are referred to as income tax etc.