Taxpayers and the scope of taxable income(Classification for residential status)

個人は居住形態の区分に応じて所得税等を納める義務があります。

1 居住形態の区分

① 居住者

国内に住所を有し、又は現在まで引き続いて1年以上居所を有している方を居住者といいます。

居住者のうち、日本の国籍を有しておらず、かつ、過去 10 年以内において国内に住所又は居所を有し ていた期間の合計が5年以下である方を非永住者といいます。

② 非居住者

上記①の居住者以外の方を非居住者といいます。

(注) 国内に居所を有していた方が一時的に国外に赴き、その後再び入国する意図で出国した場合には、 その在外期間中も引き続き国内に居所を有するものとして取り扱われます。

出国が一時的なものだという意図は、在外期間中に、a)その方が国内に配偶者などの親族を残 している、b)再入国後起居する予定の家屋やホテルの一室などを保有している、c)生活用動産 を預託しているといったことから推定されます。

(参考1) 納税義務者の区分

(1) 入国後1年を経過する日まで住所を有しない場合

入国後1年を経過する日までの間は「非居住者」、1年を経過する日の翌日以後は「居住者」

(2) 入国直後には国内に住所がなく、入国後1年を経過する日までの間に住所を有することとなった場合

住所を有することとなった日の前日までの間は「非居住者」、住所を有することとなった日以後は 「居住者」

(3) 日本の国籍を有していない居住者で、過去10年以内において国内に住所又は居所を有していた期間の 合計が5年を超える場合

5年以内の日までの間は「非永住者」、その翌日以後は「非永住者以外の居住者」

1 Classification for residential status

1) Residents

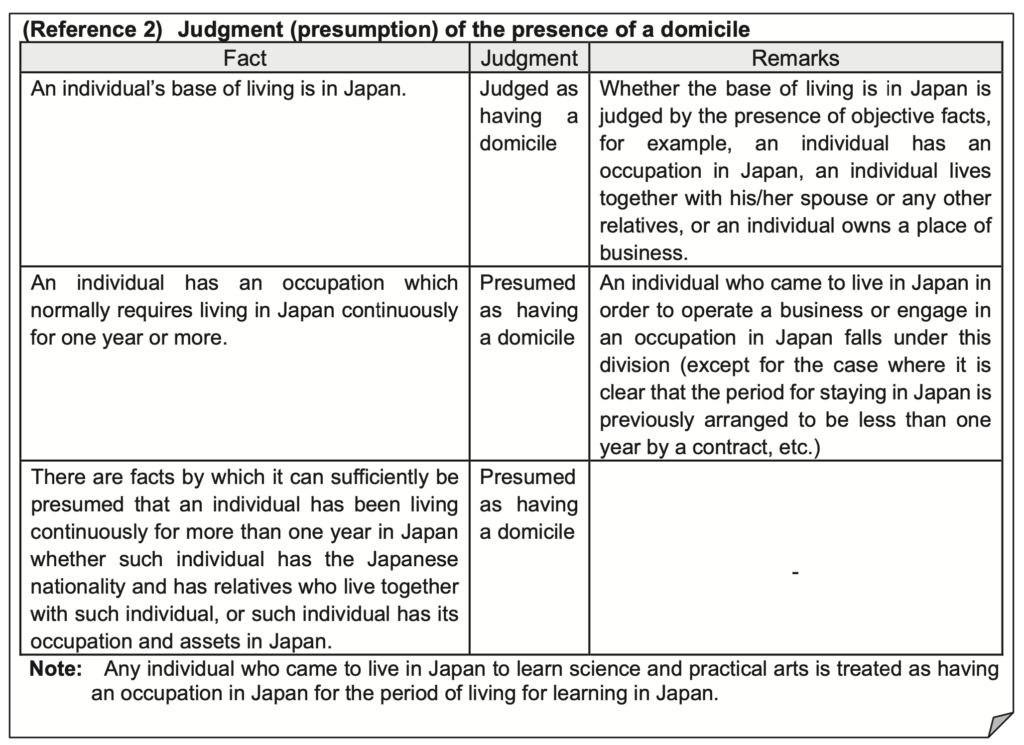

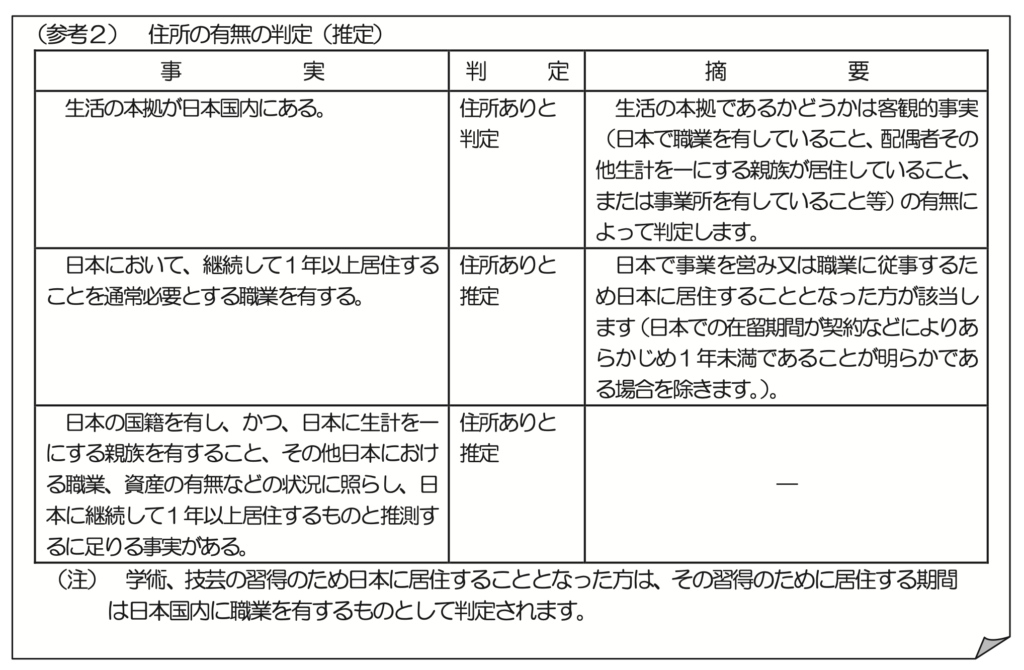

Any individual who has a “JUSHO (domicile)” or owns a “KYOSHO (residence)” continuously for one year or more is classified as a resident.

Among residents, any individual of non-Japanese nationality who has had a domicile or a residence in Japan for an aggregate period of five years or less within the preceding ten years is classified as a non-permanent resident.

2) Non-residents

Any individual other than the residents mentioned in “1) Residents” above is classified as a non-resident.

Note

If a person who owns a residence in Japan leaves Japan with the intent to be absent temporarily and later reenter Japan, the person shall be treated as having been residing in Japan during the period of absence.

The intention to be absent temporarily will be presumed if, during the period of absence, (a) the person’s spouse or relatives remain in the household in Japan, (b) the person retains a residence or a room in a hotel for residential use after returning to Japan, or (c) the person’s personal property for daily use is kept in Japan for use upon return to Japan.

(Reference 1) Classification of taxpayers

- In cases where an individual has not owned his or her domicile during the period from the date of entry into this country to the date on which one year has elapsed.

- The individual mentioned above is deemed “a non-resident” until the date on which one year has elapsed from the date of entry into this country and “a resident” after the date following that on which one year has elapsed.

- In cases where an individual did not own his or her domicile in this country immediately after entry into this country, but has owned his or her domicile during the period from the date of entry into this country to that on which one year has elapsed.

- The individual mentioned above is deemed “a non-resident” until the date before that on which he or she owned his or her domicile and “a resident” after the date on which he or she owned his or her domicile.

- In cases where an individual is a resident of non Japanese nationality and the period during which he or she has owned his or her domicile or residence in this country exceeds five years or more within the last ten years.

- The individual mentioned above is deemed “a non-permanent resident” until the date on which five years have elapsed and “a resident other than a non-permanent resident” after the date following that on which five years have elapsed.